Kroll Valuation Insights H1 2024 is Out Now. Read more.

Valuation Insights H1 2024

The Equity Risk Premium (ERP) is a key input used to calculate the cost of equity capital within the context of the Capital Asset Pricing Model (CAPM) and other models. The ERP varies over time.

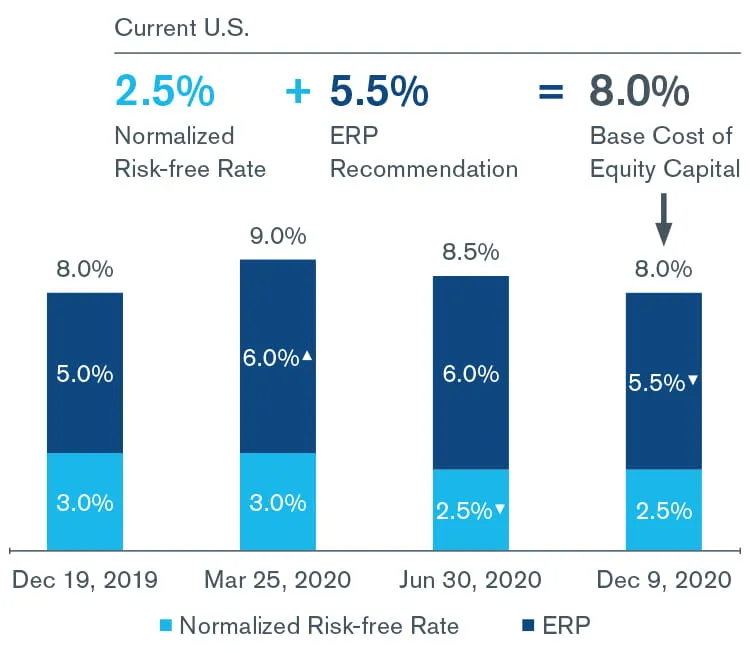

Based on current market conditions, Duff & Phelps decreased its U.S. ERP recommendation from 6.0% to 5.5% when developing discount rates as of December 9, 2020, and thereafter, until further guidance is issued.

The 5.5% ERP recommendation is to be used with a normalized risk-free rate of 2.5%, implying a “base” U.S. cost of equity capital estimate of 8.0% (2.5% + 5.5%).1

If the spot yield-to-maturity on 20-year U.S. Treasuries were used instead, the ERP would have to be increased accordingly. For example, the ERP inferred by the Duff & Phelps Recommended U.S. ERP (developed in conjunction with a normalized risk-free rate) against the spot 20-year yield of 1.5% as of December 9, 2020, is:

Duff & Phelps last changed its U.S. ERP recommendation on March 25, 2020. On that date, our recommendation was increased to 6.0% (from 5.0%) in response to the financial markets’ turmoil and the uncertainty created by the spread of COVID-19 and its corresponding negative impact on the global economy.

U.S. real GDP collapsed 5% and 31.4% in the first and second quarters of 2020, respectively, but it grew in real terms by an annualized 33.1% in the third quarter.1,2 In the fourth quarter, U.S. equity markets reached new all-time highs, spurred by optimism about the new COVID-19 vaccines, the expectation of continued low interest rates through at least 2023, the resolution of the U.S. presidential election, and improved business confidence. Consumer confidence also saw some improvement since its 2020 low in April, but it remains far below the levels observed prior to the outbreak.

Exhibit 1 lists the primary factors that were considered when arriving at the Duff & Phelps Recommended U.S. ERP, effective December 9, 2020. It documents the evolution of these factors from March 25, 2020 through November 30, 2020, and their corresponding impact on the ERP.

Exhibit 1: Factors Considered in the U.S. ERP Recommendation: Relative Change from March to November 2020

There are several risks that may impact the shape of the U.S. economic recovery and the pattern of behavior of financial markets in 2021, including:

Based on global economic and financial market conditions in late November and early December 2020, which took into consideration the outlook and potential risks for 2021, we found sufficient support to decrease our U.S. ERP recommendation to 5.5% as of December 9, 2020 and thereafter, until further notice.

The 5.5% ERP recommendation is to be used with a normalized risk-free rate of 2.5%, implying a “base” U.S. cost of equity capital estimate of 8.0% (2.5% + 5.5%). Exhibit 2 shows the fluctuations in the base U.S. cost of equity since year-end 2019 to the present, using the Duff & Phelps Recommended U.S. ERP and accompanying risk-free rate.

Duff & Phelps continuously monitors global economic and financial market conditions that may indicate a change in the indicated ERP and will update our guidance as frequently as warranted.

Exhibit 2: U.S. Base Cost of Equity (= U.S. Normalized Risk-Free Rate + Duff & Phelps Recommended U.S. ERP)

December 19, 2019 to the Present7

Sources

1.As published in the Duff & Phelps Cost of Capital Navigator at dpcostofcapital.com. The Cost of Capital Navigator is an interactive, web-based platform (subscription required) that guides finance professionals through the steps of computing cost of capital taking into account best practices and the latest theory on this topic.

2 .Source: U.S. Bureau of Economic Analysis (BEA). Third quarter U.S. real GDP was later revised to 33.4%. See: https://www.bea.gov/news/blog/2020-12-22/gross-domestic-product-third-estimate-corporate-profits-revised-and-gdp.

3 U.S. real GDP decreased an estimated 3.5% in 2020 (compared to an increase of 2.2% in 2019). See: https://www.bea.gov/news/2021/gross-domestic-product-4th-quarter-and-year-2020-advance-estimate.

4 This section has been updated with more recent information relative to the content included in the client alert “Duff & Phelps Recommended U.S. Equity Risk Premium Decreased from 6.0% to 5.5%, Effective December 9, 2020”. This client alert contains a more expanded discussion of the rationale used to support the decrease in the Duff & Phelps-recommended U.S. ERP on December 9, 2020, and is accessible here: https://www.duffandphelps.com/insights/publications/cost-of-capital/duffandphelps-recommended-us-equity-risk-premium-decreased-december-2020

5Source: FDA’s Emergency Use Authorization information available at: https://www.fda.gov/emergency-preparedness-and-response/mcm-legal-regulatory-and-policy-framework/emergency-use-authorization#coviddrugs.

6Source: Centers for Disease Control and Prevention (CDC) website at: https://covid.cdc.gov/covid-data-tracker/#vaccinations

7Assumes a market beta of 1.0.

Our valuation experts provide valuation services for financial reporting, tax, investment and risk management purposes.

When companies require an objective and independent assessment of value, they look to Kroll.

Heightened regulatory concerns and vigilance, together with increased investor scrutiny, have led to increased demand for independent expert advice.

Leading provider of real estate valuation and consulting for investments and transactions.

Built upon the foundation of its renowned valuation business, Kroll's Tax Service practice follows a detailed and responsive approach to capturing value for clients.

Kroll's team of internationally recognized transfer pricing advisors provide the technical expertise and industry experience necessary to ensure understandable, implementable and supportable results.

Kroll provides clients the transparency they need by identifying, managing, and valuing their fixed assets.

by David Scott, Miguel Peleteiro, Diogo Pais