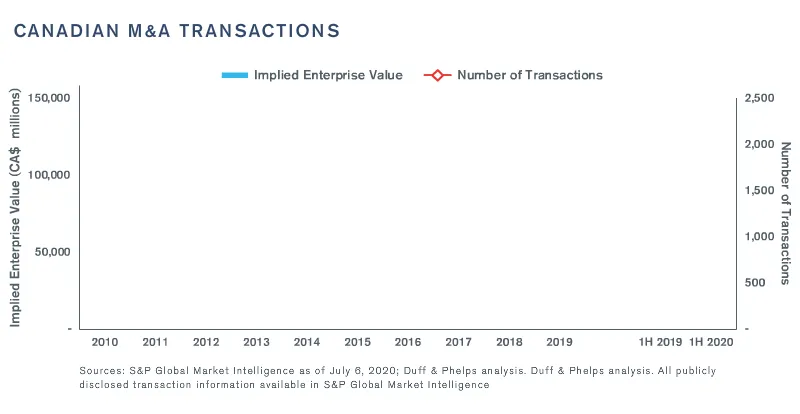

In 1H 2020, Canadian M&A activity declined in both transaction count and total implied enterprise value (EV) as the effects of the COVID-19 pandemic, along with growing political tensions across the world, caused significant concerns for investors. There were 736 Canadian companies sold over the course of 1H 2020, representing total disclosed EVs of $36.9 billion. Of the transactions completed, 75.7% were domestic acquisitions, a number which is in line with historical averages.

COVID-19 has significantly impacted M&A activity in both Canada and abroad. The extent and severity of the disruption in the longer-term remains to be seen, but a number of industries have been hard hit including energy, travel and hospitality. Some sectors, such as food and beverage and healthcare have seen some benefit in the short-term and may be less affected looking forward. The total number of distressed sales and restructurings has risen dramatically, a trend that will likely continue.

While there’s still an abundance of liquidity in the market among strategic buyers and private equity funds, many buyers could be hesitant to undertake major investments. Buyers focused on stabilizing their existing operations earlier in the year are again starting to look at new opportunities. Activity among private equity firms has also begun to pick up in recent weeks. Firms making acquisitions should enjoy a strong negotiating position, as the market in certain industries appears to have shifted from seller-friendly to buyer-friendly. Organizations with healthy balance sheets may see this as an opportunity to acquire high quality assets at discounted prices.

Governments around the world have invoked unprecedented economic measures to help workers and businesses. Central banks have made emergency rate cuts. However, banks may be too busy managing their current portfolios to pursue new business. In any event, the amount of leverage available will likely decline or become more restrictive, which could compress valuation multiples.

Source

S&P Global Market Intelligence as of July 6, 2020; Duff & Phelps analysis. All publicly disclosed transaction information available in S&P Global Market Intelligence.

For all data herein: All transaction values are in Canadian dollars (unless otherwise noted) and refer to transactions with reported financial data. All transaction data refers to acquisitions of majority stakes (minority deals were excluded). M&A transactions in 1H 2020 include those between January 1 and June 30, 2020.