OECD Pillar Insight Simulation

Progress Towards Pillar One and Pillar Two Implementation

Years in the making, the “two-pillar solution” aimed at addressing taxation of the modern digital economy is becoming more of a reality. As of November 4, 2021, 137 member jurisdictions of the OECD/G20 Inclusive Framework on Base Erosion and Profit Shifting (BEPS) (“the IF”) had agreed to Pillar One and Pillar Two. With certain proposed effective dates beginning as soon as 2023, the IF has advanced several workstreams concurrently, and we expect further proposed guidance to be released regularly until Summer 2022.

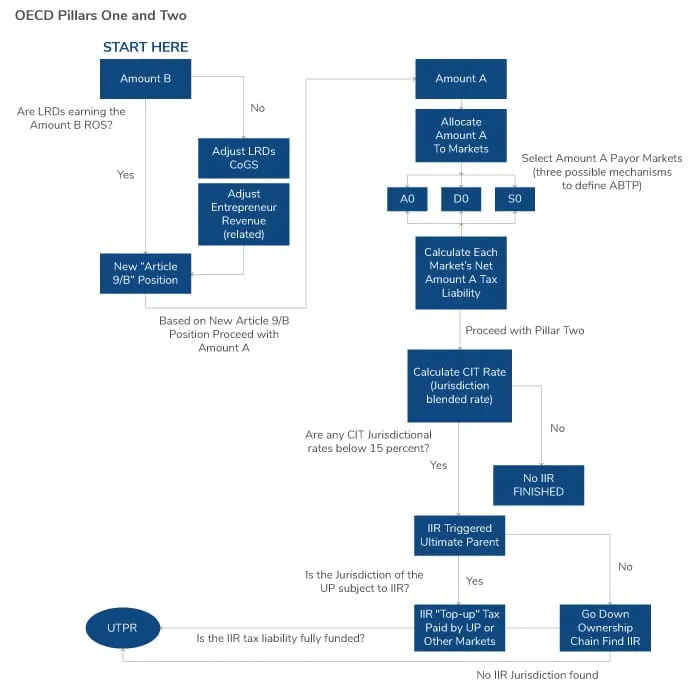

At a high-level, Pillar One and Pillar Two are intended to: 1) reallocate profits and taxing rights of the largest and most profitable MNEs, 2) provide a minimum return to baseline marketing and distribution activities, and 3) ensure that MNEs are subject to a minimum tax rate of 15%.

Over the course of 2021 and the first quarter of 2022, additional details around both pillars have been shared, including draft model rules and associated guidance for public consultation. That said, certain key mechanisms are still to be ironed out, and it is almost certain that some modifications will be made during that process.

One important policy decision facing the IF is the reallocation mechanism for Amount A under Pillar One. Specifically, the IF will need to determine which entities within an MNE will be responsible for providing tax relief to those jurisdictions entitled to the new Amount A taxing rights while avoiding double taxation of the same income. Currently, three mechanisms appear to be considered; the results of which vary from responsibility sitting solely with entrepreneurs in the structure vs. being shared by all profitable entities, whether limited in risk or entrepreneurs. The effective tax rate (ETR) impact of these mechanisms will vary depending on an MNE’s footprint, high-tax vs. low-tax income, and tax assets. Understanding the spectrum of potential ETR outcomes enables an MNE to proactively plan as the IF settles this issue.

OECD Pillar Insight Simulation Offer

The Kroll model simulates the potential impacts of Pillar One (Amount A and Amount B) and Pillar Two, including calculating the results across all three scenarios that the IF is currently studying to select entities providing Amount A tax relief.

Our model:

- Uses readily available financial and tax data (i.e., the country-by-country report)

- Quickly calculates and compares future-state taxable income and ETRs

- Decomposes the ETR impacts, which allows an MNE to better understand the fundamental economic drivers of these impacts without the noise of other factors (e.g., specific tax attributes), which can ultimately be layered in as appropriate

Flowchart of the Simulation

Our simulation output describes the mechanics of the proposals, including visibility into the definitions and quantum of components, order of calculations required and the market-interconnectedness of jurisdictions across the MNE. It also highlights the technical elements that have yet to be decided.

Ultimately, the simulation allows for:

- Comparing current state and expected future state under various assumptions, including three definitions of ability to pay for funding the tax relief of Amount A

- Tracing causation of certain impacts (e.g., to the ETR) and identifying potential mitigation opportunities

- Identifying ancillary tax issues (or benefits) that can arise from an MNE’s specific tax attributes (e.g., foreign tax credit excess limits or credits in various baskets)

- Considering interaction effects with other country-specific tax changes that might also impact results (e.g., the U.S. “attribution” rule under Section 901) or countries adopting a domestic Qualified Income Inclusion Rule regime.

Our simulation benefits not only MNEs that currently meet the Pillar One and Pillar Two inclusion thresholds but also those on the cusp of the thresholds and/or those concerned with lower thresholds in subsequent years.1

This material is for educational or informational purposes only. It does not constitute legal, accounting, or other professional advice. While we have attempted to provide reliable information, it is not guaranteed to be complete, accurate, or timely. Kroll LLC expressly disclaims any liability arising from the use of this material.

Sources

1.Pillar One applies to MNEs with turnover of > €20 billion and profitability before tax of > 10%. Pillar Two applies to MNEs with a consolidated annual revenue threshold of > €750 million.

Contact us for a copy of our full simulation output on a hypothetical MNE or to discuss applying our simulation to your organization.

Request a Simulation

Valuation

Valuation of businesses, assets and alternative investments for financial reporting, tax and other purposes.

Cyber and Data Resilience

Incident response, digital forensics, breach notification, security strategy, managed security services, discovery solutions, security transformation.

Compliance and Regulation

End-to-end governance, advisory and monitorship solutions to detect, mitigate and remediate security, legal, compliance and regulatory risk.

Corporate Finance and Restructuring

M&A advisory, restructuring and insolvency, debt advisory, strategic alternatives, transaction diligence and independent financial opinions.

Investigations and Disputes

World-wide expert services and tech-enabled advisory through all stages of diligence, forensic investigation, litigation, disputes and testimony.

Business Services

Expert provider of complex administrative solutions for capital events globally. Our services include claims and noticing administration, debt restructuring and liability management services, agency and trustee services and more.