Mon, Nov 25, 2024

NFL - Its Unique Strategy and Dominating Valuation Proposition

Unlike the NBA and MLB, where local media rights play a significant role, the NFL’s operating model relies on national revenue streams, a formula that has proved exceptionally effective.

The proliferation of streaming technology not only transforms the landscape of sports broadcasting and viewership but also offers an opportunity to solidify the NFL’s winning approach. This accelerating shift to streaming and its potential value creation emphasizes the urgency for other major U.S. leagues to reassess their strategies. Adopting a model akin to the NFL’s, with a focus on national revenue models enhanced by streaming, could perhaps unlock new levels of success and fan engagement.

The concept of revenue sharing, a cornerstone of the NFL’s strategy, emerges as a potentially transformative approach for elevating team values across the board. This analysis delves into these critical considerations, exploring whether the rest of the sports world will follow in the NFL’s footsteps or carve their own paths to success.

Business of Sports

The business of professional sports differs from most businesses because it is essentially a collection of teams, privately owned in a club model. Leagues operate under their own set of rules and guidelines, defined under their respective collective bargaining agreements.

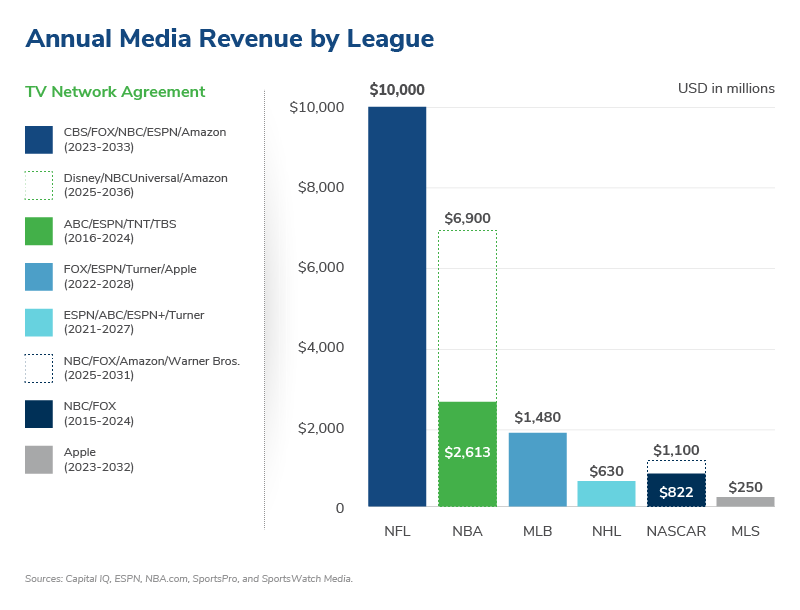

The NFL is the most dominant sports league in the world by viewership and revenue. Like all sports leagues, its revenues falls into two main categories: national and local. Unlike other major U.S. sports leagues such as NBA, MLB, and NHL, the NFL’s operating model relies heavily on national revenue. In this operating model, national revenues are shared equally among all teams in the league, while local revenues remain under individual team control. National revenues mainly consist of the sale of media rights that reach a national audience while local revenues include venue-related revenues (ticketing, concessions, sponsorship, etc.), and local media rights sales, which include TV and radio broadcast rights available only within their local markets.

Comparative Analysis of Leagues Structure and Strategy

Each league is also structured fundamentally differently, with their Collective Bargaining Agreements (CBAs) reflecting the unique characteristics of each. CBAs cover key points such as salary structure, free agency and team schedules and playoff formats. For example, in the NFL the season consists of only 17 games while at the other extreme MLB teams play 162 games in a season. Also, the NFL employs a hard salary cap, unlike many other major sports leagues. These fundamental characteristics significantly influence the revenue and income derived by teams in each league.

The NFL’s relatively low number of games creates scarcity, boosting demand for its product. This scarcity has allowed the NFL to focus its operating strategy on the national market. With a limited inventory of games to broadcast each week, NFL games are featured on major television networks and streaming platforms, including showcase games on Thursday, Sunday and Monday nights. These games attract a large nationwide audience, translating into billions in annual revenue for its teams to share. In fact, the NFL negotiated an 11-year media rights package last year worth upwards of $110 billion. According to SportsMediaWatch.com, all 56 of the most-watched sporting events in 2023 were NFL games, and 96 of the 100 most-watched TV broadcasts in 2023 were NFL games, an increase from 82 in 2022.

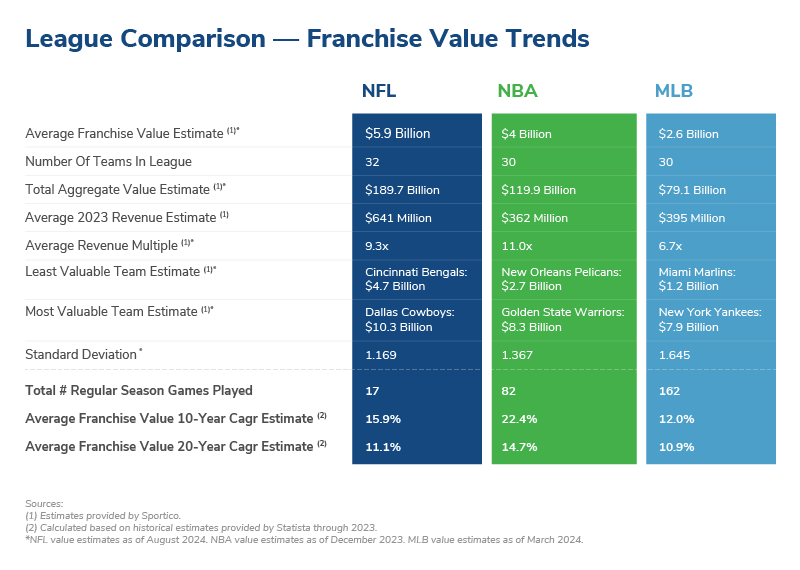

The MLB reupped its national media contracts in 2022, amounting to $12.6 billion over seven years. MLB teams also individually negotiate media contracts for the local broadcast of its games. Due to the MLB’s heavy reliance on local revenues, the value of its teams is closely linked to the size of the markets where the teams operate, reflecting the ability of large-market teams to generate larger amounts of local revenue, primarily media rights. Professional sports franchises are typically valued based on a multiple of revenue and revenues are substantially higher in larger markets amongst MLB teams. In contrast, there is less variation in NFL teams’ annual revenue because the majority of the revenues are evenly shared, leading to less variance in NFL team values.

Similarly, the NBA operates much like the MLB where a substantial amount of its revenues come from local sources, arguably due to its 82-game schedule. However, the NBA’s revenue from national TV contracts has grown significantly, reflecting its increasing popularity. The NBA recently renegotiated its national media rights with its partners, which were due to expire in 2025. The new deal includes ABC/ESPN, NBC and Amazon and reflects a 3x increase in license fees over of its existing contracts. At nearly $75 billion over 11 years, the deal amounts to nearly $7 billion per season. (insert graph)

The distinctive operational and revenue models of the NFL, MLB and NBA highlight the significant impact of leagues’ structures and strategy on their ability to create value. The NFL’s national focus, hard cap, and revenue-sharing model promote financial parity among teams, contrasting with the MLB’s and NBA’s heavier reliance on local market revenues, which can lead to greater disparities in team values.

Team Performance and Valuation

In 2023, the Detroit Lions reached the NFL championship following one of the longest periods of underperformance in league history, having won only one playoff game in the preceding 58 years. Despite being in a midsize market in a city facing long-term economic challenges, the Lions are now one of the most popular teams in the NFL under the leadership of its fiery coach, Dan Campbell. The team has a roster of improving talent and has appeared on the NFL documentary series “Hard Knocks.”

The Lions are poised to see an uptick in ticketing, sponsorship and playoff-related revenues due to their recent success. On the flip side, the New England Patriots, despite their storied history, have encountered challenges recently. The 2023 season concluded with the Patriots recording one of the league’s worst performances, and the franchise parted ways this year with its longtime coach, Bill Belichick. The Patriots operate in a much larger market than the Lions, and the Patriots’ brand has long benefited from their historical achievements. However, in the post-Tom Brady era and following a trend of declining performance, the question arises: Can the Patriots sustain their previously high revenue levels?

Playoff revenues in general are an uncertain source of future revenues for teams due to the difficulty of qualifying each year.1 Stadium revenues in general may not vary much among teams because each NFL team plays only eight home games per season, and the teams sell out their home games in most cases. Sponsorship revenue is generated by the league on a national basis, as well as the teams as a local revenue source through selling in-stadium sponsorship. Therefore, larger market teams and more popular teams will likely generate more sponsorship dollars in local revenues, but the impact may be somewhat muted by the sharing of national sponsorship dollars. (The Dallas Cowboys, widely considered to be the most valuable NFL franchise, maintains a strong brand and correspondingly generates the largest amount of sponsorship income in the league.)

NFL’s Success and Its Operating Model

Why is the National Football League so successful then? It may simply be because they play fewer games. As a result, its strategy has developed around this fundamental structure with an emphasis on competitive balance, national promotion, and distribution of its games, and sharing of its primary sources of revenue.

The basic economic principle of supply and demand explains a large part of the difference in values and the corresponding strategy employed by each league. The NFL commands a premium price for its media rights due to its scarce inventory of games, not unlike how LVMH, Prada or Ferrari limit their inventories to drive high demand and premium pricing for their products.

College football also appears to be following suit with the NFL, consolidating into a handful of power conferences that command megadollar broadcast deals with the ability to reach a larger national viewing audience.

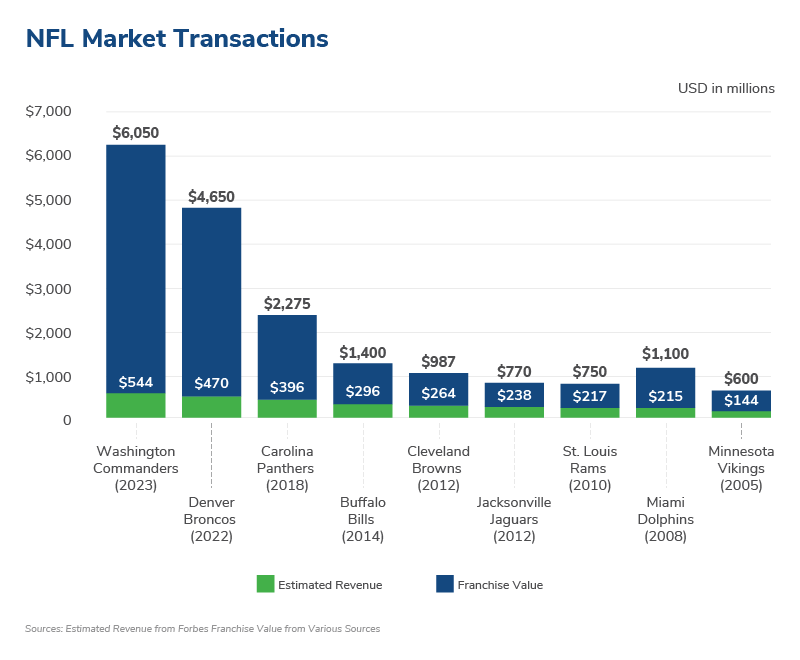

Multiples paid for sports franchises have risen dramatically over the past 10 to 20 years as teams’ media revenues have grown (Add Average Franchise Value.png). The 2023 sale of the NFL’s Washington Commanders to a group led by Josh Harris marked the highest-priced sports team transaction in history at $6.05 billion.

It must be pointed out that the NBA is closing the gap with the NFL in both multiples paid for its franchises and their potential franchise values. Following its successful championship run last season, and the newly inked NBA national media deal, the Boston Celtics are rumored to be for sale. Like the NFL’s Commanders, the Celtics will likely demand a $6 billion plus value reflecting a revenue multiple of 10 times or greater. The Celtics also benefit from its long and successful history, strong brand and large local market. However, not all NBA franchises can demonstrate these valuable characteristics.

Possible Solution to Replicating NFL’s Success: Streaming

Can the NBA, MLB, NHL and other professional sports leagues enhance their success by also leaning into a more nationally focused strategy? The answer may lie in the timing and evolution of streaming distribution. For instance, the NBA’s national media revenues are growing at a faster rate than its teams’ local media revenues. This shift is partly due to the decline in linear television, causing regional sports networks (RSNs) to struggle. Diamond Sports, the largest RSN owner broadcasting local games for various NBA, MLB and NHL teams, filed for bankruptcy last year and subsequently struck a deal with Amazon for the distribution of a large number of games. It is unclear whether leagues will adopt structures in which revenues will be shared equally going forward. The deal with Amazon may be a precursor to these leagues developing a national streaming distribution plan for their local games.

Distribution of sporting events via streaming is rapidly taking shape and, although uncertain, may provide a path to increased revenues and exposure for leagues and teams. An example of this is Peacock's experiment with streaming the Kansas City Chiefs vs. Miami Dolphins AFC wildcard playoff game on January 14, 2024. Despite having only 31 million paying subscribers at that time, Peacock achieved an average viewership of 23 million for the game which resulted in nearly 3 million new sign-ups for the service.2 And now under the NBA’s new media deal, NBCU plans to distribute a majority of its NBA games on Peacock.

Amazon significantly upped its investment in sports streaming as a major partner of the new NBA deal. Amazon’s Prime Video will pay $1.8 billion per year for global streaming rights to certain regular season and playoff games.

Arguably the most aggressive shift to streaming was exemplified by Major League Soccer or MLS, which entered an exclusive media agreement with Apple in 2022, leaving behind the traditional broadcast television model. The 10-year, $2.5 billion deal began with the 2023 season and offers all MLS games via AppleTV for a monthly subscription.

On a larger scale, Fox Corp., ESPN and Warner Bros. Discovery have announced the creation of a joint streaming platform to share sports assets. The stand-alone service, Venu Sports, would be available to ESPN+, Hulu and Max subscribers and each company will own one-third. The specifics of this deal—particularly how it will affect leagues, teams and viewers—remain largely secret. And FuboTV, the sports-focused streaming platform, has won a preliminary injunction to block Venu’s launch based on antitrust concerns, further complicating the future of this service.

The Path Forward

Although there are legacy issues and structural differences between the NFL and other leagues, the other leagues have most likely maximized the revenue potential of their local markets and streaming technology provides an efficient distribution method to reach larger audiences and generate increased revenue.

The distribution power and technological benefits of streaming will lead to a more nationally focused media strategy for all sports leagues. While maximizing revenue in a team’s local market remains imperative, the opportunity to expand to a broader national or even international audience under a collective team model can lead to higher revenues and team values.

Notes:

1 Non-playoff teams can benefit from how playoff revenues are generated as they share in that source, as well as share in the allotment of revenue share income.

2 The game was also broadcast on NBC affiliates in Kansas City and Miami and on NFL+, according to Nielsen.

Valuation Advisory Services

Our valuation experts provide valuation services for financial reporting, tax, investment and risk management purposes.

Valuation Services

When companies require an objective and independent assessment of value, they look to Kroll.