The Duff & Phelps 2020 U.S. Goodwill Impairment Study, now in its 12th year of publication, examines general and industry goodwill impairment (GWI) trends of over 8,800 U.S. publicly traded companies through December 2019.

This edition also gives a preview of the impact of the COVID-19 pandemic on goodwill impairments taken by U.S.-based public companies. Times of crises and significant economic recessions always place an additional focus on impairments recorded by publicly traded companies.

Download the Report

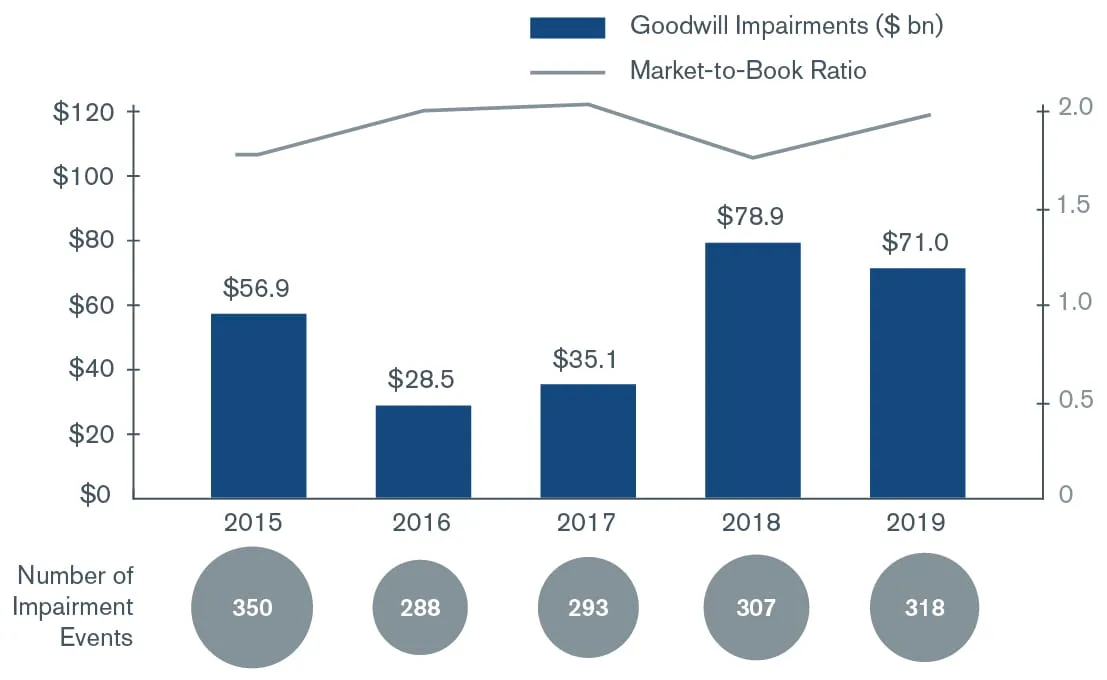

Total GWI recorded by U.S. publicly traded companies fell by 10% from $78.9 billion (bn) in 2018 to $71 bn in 2019. However, this was still the second highest level after the 2008 financial crisis.* A single GWI event of $22.1 bn recorded by General Electric (GE) had the highest impact on the 2018 aggregate GWI amount. If GE’s impairment event was excluded from the 2018 totals, aggregate GWI would have risen by 25% in 2019.

The chart below shows trends in GWI in dollar amount and number of impairment events over the last five years.

Goodwill Impairment History

For seven of the 10 industries analyzed, GWI increased or remained at similar levels, with Industrials and Consumer Discretionary being notable exceptions. Industrials saw its aggregate GWI drop by over 80% in 2019, but that was driven by a single large event in 2018 (GE’s $22.1 bn).

Communication Services, Information Technology and Consumer Staples were the top three industries with the largest increase in GWI in 2019. Consumer Staples reached a new record high in aggregate GWI, while Communication Services saw its highest level since 2007.

The graphic below highlights trends in the aggregate GWI amount for each of the 10 industries analyzed over the period 2015-2019.