Duff & Phelps Real Estate Advisory Group, A Kroll Business, has published a new market study, Real Estate Investments in Europe, which provides an overview of the latest real estate sector data from Q1 2021 and the last few quarters of 2020.

The study provides in-depth information on:

- The evolution of COVID-19 in Europe and its economic impact

- Trends of the main macroeconomic indicators related to the 27 EU member countries

- Investment trends of the last 10 years in Europe’s real estate sector

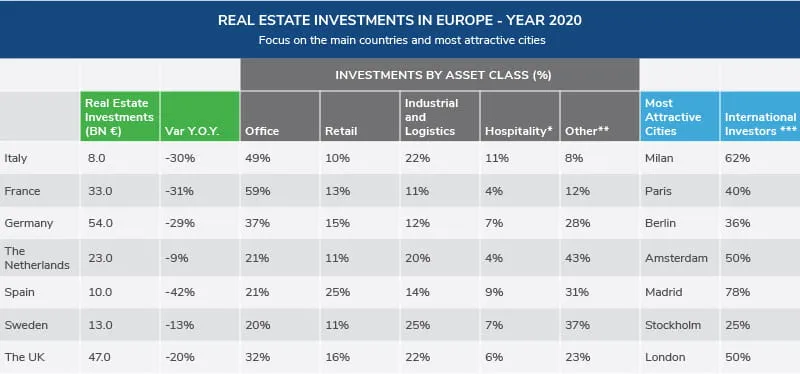

- Transacted volumes in Europe in 2020 (referred to Germany, France, the UK, the Netherlands, Sweden, Spain and Italy), focusing on the main countries and most attractive cities in Europe

- The analysis of real estate investments in Europe in Q1 2020

Read now.

* Hospitality: hotel and alternatives (student housing, health care, senior living, etc.)

** Other: residential building, development of greenfield or brownfield areas and assets not ascribable to a specific asset class

*** Percentage on the total of real estate investments

In 2020, the seven most attractive countries—Germany, France, the UK, the Netherlands, Sweden, Spain and Italy—together amounted to 190 billion euros (a decrease in 25% from 2019) of the total of real estate.

This document offers an overview of the European real estate market performance in terms of investments in 2020 (the historical year of the beginning of the COVID-19 pandemic) and results related to Q1 2021. The document highlights how there is still uncertainty in the sector in the first months of the current year, but simultaneously, renewed interest in real estate operations in the residential sector or real estate development and logistics.