Global Oil and Gas M&A Outlook–Q1 2025

by David Scott, Diogo Pais

Wed, Jan 27, 2021

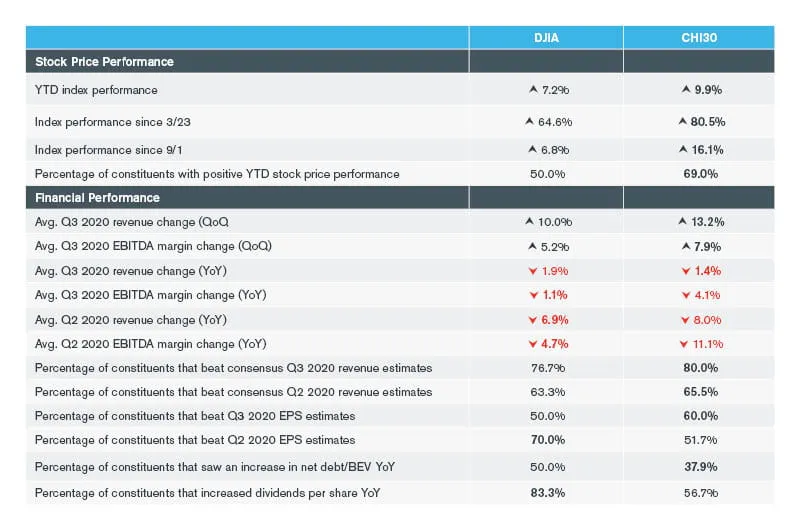

Kroll analyzed a price-weighted index of Chicago’s 30 largest publicly traded companies by market capitalization (the CHI30). The Dow Jones Industrial Average (DJIA) is comprised of diversified companies and some of the largest in the U.S. ($204 billion median market cap vs. $28 billion median market cap of CHI30).

Key highlights from the report:

The CHI30 performed worse than the DJIA on most Q2 financial performance metrics, but CHI30 companies performed better than the DJIA in Q3

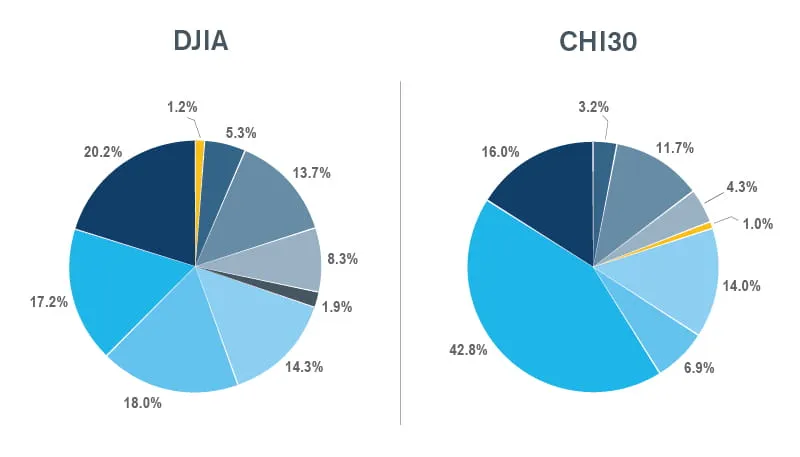

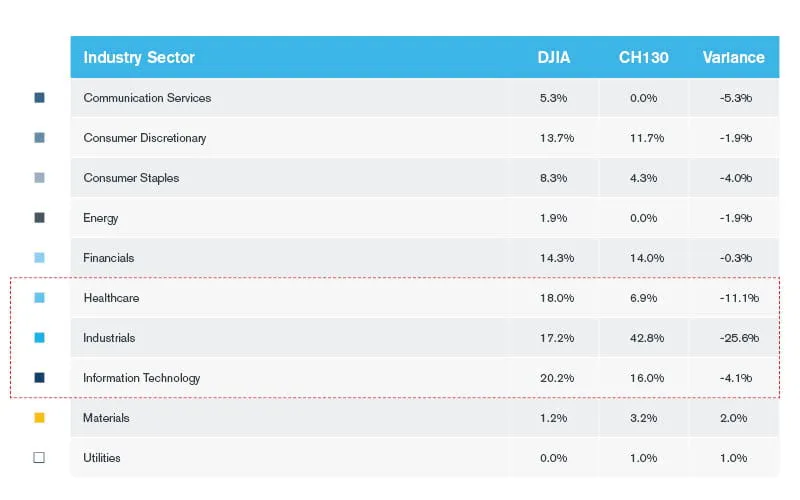

The CHI30 is overweight in industrials and underweight in information technology, healthcare and communication services.

M&A advisory, restructuring and insolvency, debt advisory, strategic alternatives, transaction diligence and independent financial opinions.

Kroll’s top ranked M&A Advisory practice spans sell-side, buy-side, due diligence, deal strategy and structuring, and capital raising.

Our Transaction Opinions solutions span fairness opinions, solvency opinions, ESOP/ERISA advisory, board and special committee advisory, and complex valuations.

Kroll’s Transaction Advisory Services platform offers corporate and financial investors with deep accounting and technical expertise, commercial knowledge, industry insight and seamless analytical services throughout the deal continuum.

Kroll has extensive experience raising capital for middle-market companies to support a wide range of transactions.

Dedicated coverage and access to M&A deal-flow for financial sponsors.

by David Scott, Diogo Pais

by Nicholas Collins, Scott Munro, Vineet Asthana, Matt De La O, Rory O'Sullivan, Corey Maurer, Hamish Shah, Philipp Bose

by Josh Benn